We primarily look for assets in a universe of approximately 250 companies that are not as well covered by stock brokers and investment firms. In this universe of investments, we believe there are significant inefficiencies and the best opportunities to find companies that are poorly priced and offer greater potential for appreciation and return to shareholders and debtholders. We arbitrage prices and values, and the wider the differences, the greater the potential for appreciation and gains for our funds and those investing in them.

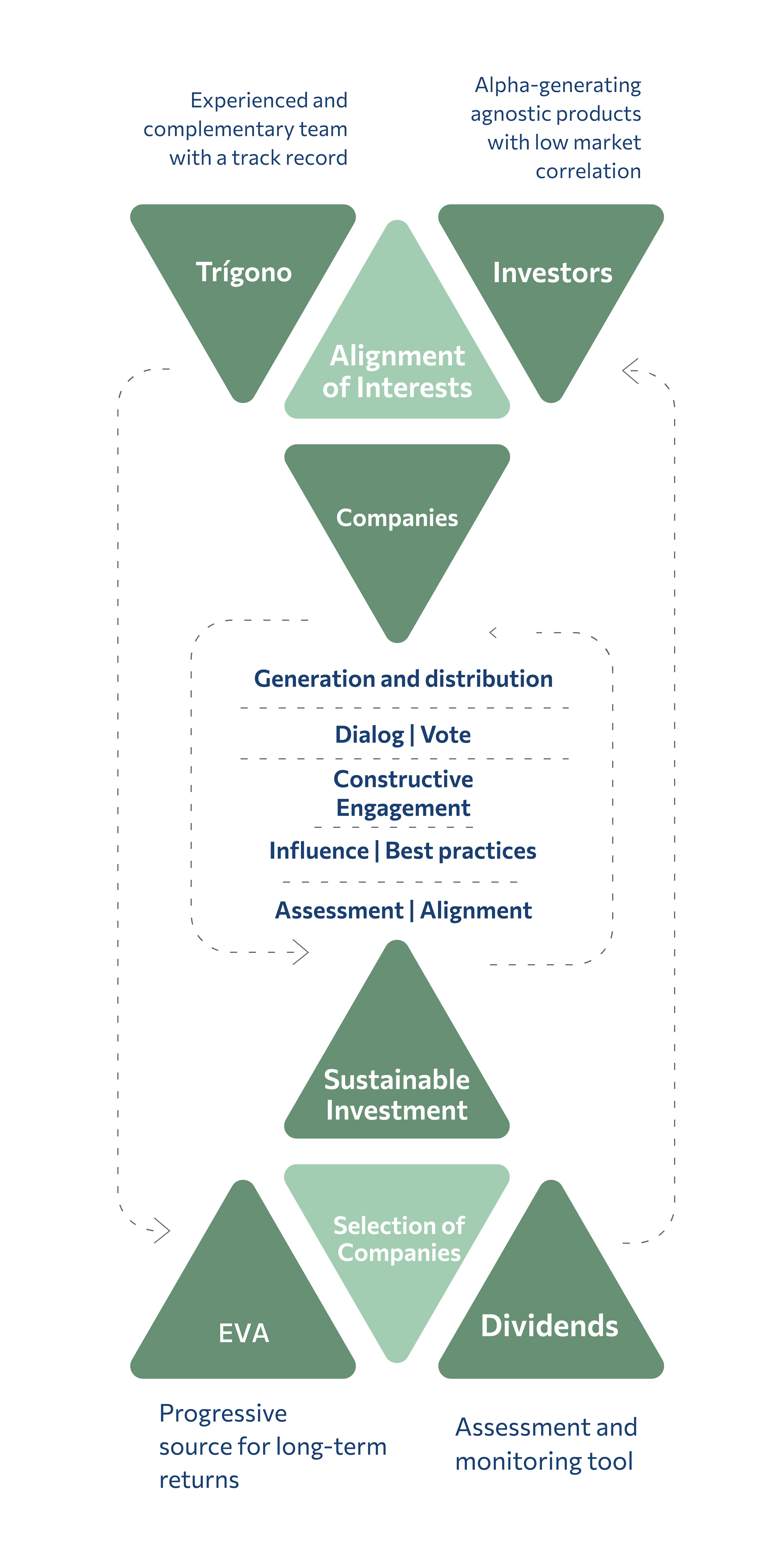

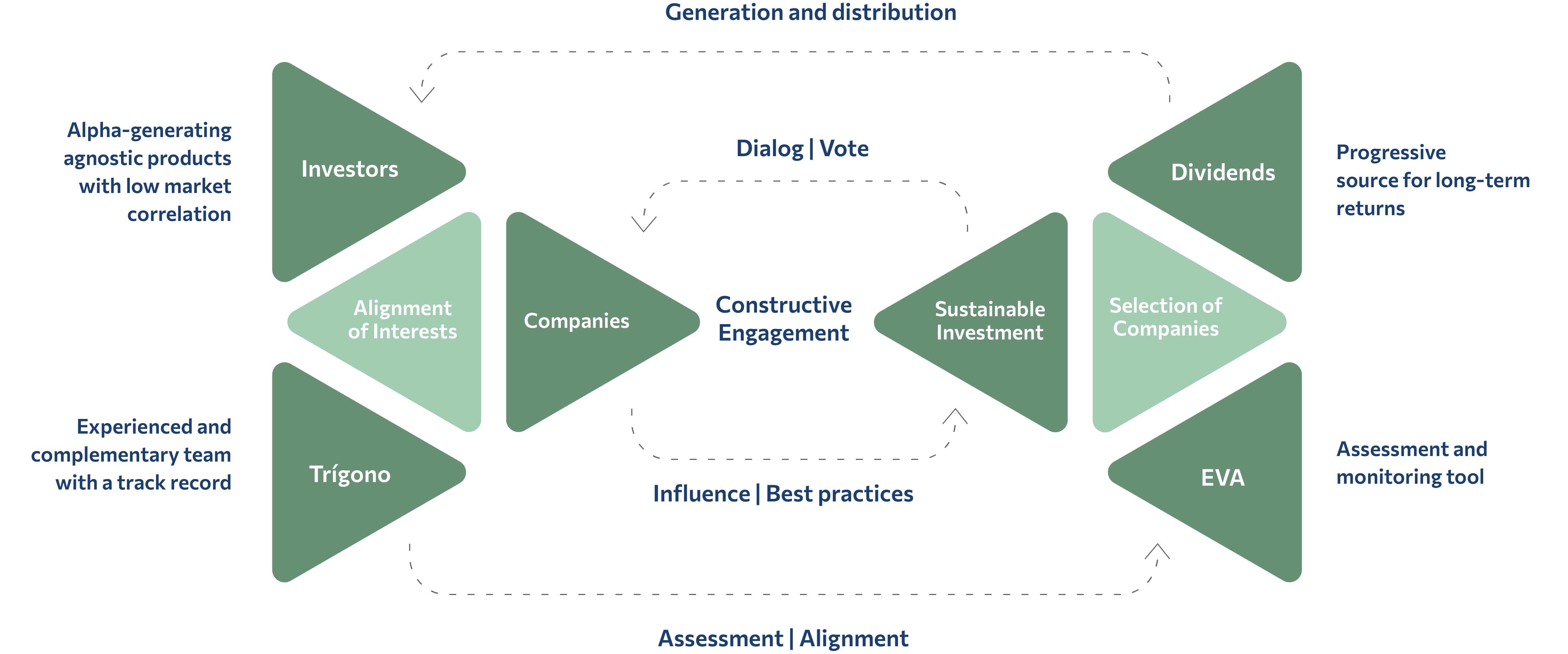

Through intense and independent research and discipline in our investment processes, we use proprietary methodologies that have been spotlighted for their innovation and are unique among Brazilian managers. Our models combine the valuation of companies through the economic value-added methodology (known as EVA, a registered trademark of Stern Stewart & Co. – currently, Stern Value Management), which basically assesses the return on invested capital over the cost of capital employed and the generation of shareholder value.

After the quantitative evaluation, we applied our proprietary ESG methodology. Through a careful evaluation of the elements that make up the ESG, we parameterized such criteria in a quantitative way. After combining the two methodologies, we determine the fair or intrinsic value of the companies analyzed and evaluated, which will serve as a basis for the investment committee and managers to compose the portfolios in a way that best satisfies the objectives of each fund. The construction of portfolios is agnostic, meaning that it does not consider companies that make up the reference indices into consideration, and is strictly based on the bottom-up precept, which looks at the value of the companies, and not at the sectors in which they operate. Our funds are therefore composed of companies with little or no participation in the benchmark indices, offering a unique opportunity for pure diversification and alpha generation to investors that have a limited correlation with indices and other funds in the same strategies.

In addition to determining the value of companies and complying with ESG principles, the dividends provided by companies have a considerable weight in the composition of the funds. About 2/3 of the total return provided by stocks throughout the world over a 20-year period is provided by dividend payout. As such, the pure appreciation of shares by the will of the market has its weight reduced to only 1/3 of the return. The longer the investment horizon, the more important the dividends for investors, especially institutional investors that do not have a defined term for their investments. The optimal balance between ESG, company value through EVA and dividends distributed by companies forms our second triangle, creating a perfectly balanced basis for building our portfolios.

In addition to the above factors, we consider and give great importance to companies that: